Get 24/7 Free Support

Footprint Action Strategy for NinjaTrader

- Home

- Footprint Action Strategy for NinjaTrader

NinjaTrader Footprint Action Strategy is a part of MZpack Strategies w Divergence for NinjaTrader 8

Features of Footprint Action Strategy

- Supports 8 orderflow signals. More signals will come soon

- Auto trade and Manual modes

- Combine choosen signals into pattern: AND, OR. Set required number of validated signals to match the pattern

- Volume and Delta filters

- Custom actions for opposite signals: Close, Reverse or None

- Advanced orders handling: Custom ATM or NinjaTrader ATM

- Time filters: allow the strategy to trade at specific times

- Daily loss and profit filters

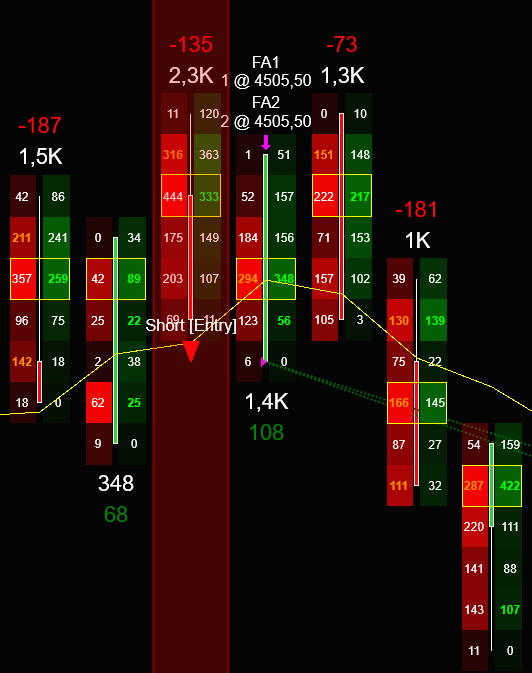

Delta Divergence Signal

The Delta Divergence is a trend reversal signal.

LONG:

– Price makes a new low with a bullish candle and positive delta

SHORT:

– Price makes a new high with a bearish candle and negative delta

EXAMPLE:

Bearish bar making a new high, but with -135 delta being formed. When the bullish bar closes the strategy will immediately open a short trade.

Delta Tail Signal

A Delta Tail signal occurs when a bar has a negative Delta at all price levels except the bottom of the bar and vice versa.

LONG:

– Bullish bar with postive delta at all prices except the bottom

SHORT:

– Bearish bar with negative delta at all price levels except the top

EXAMPLE:

On the image you see a bar that has a positive delta at all price levels except at the bottom

Delta Surge/Drop Signal

The Delta Surge/Drop signal uses a 4-bar signal. The signal happens when there is a sudden decrease in the delta and when the delta is getting weaker and weaker or when there is an increase in delta and delta is getting stronger and stronger.

LONG:

– 4 consecutive bars with increasing delta

SHORT:

– 4 consecutive bars with decreasing delta

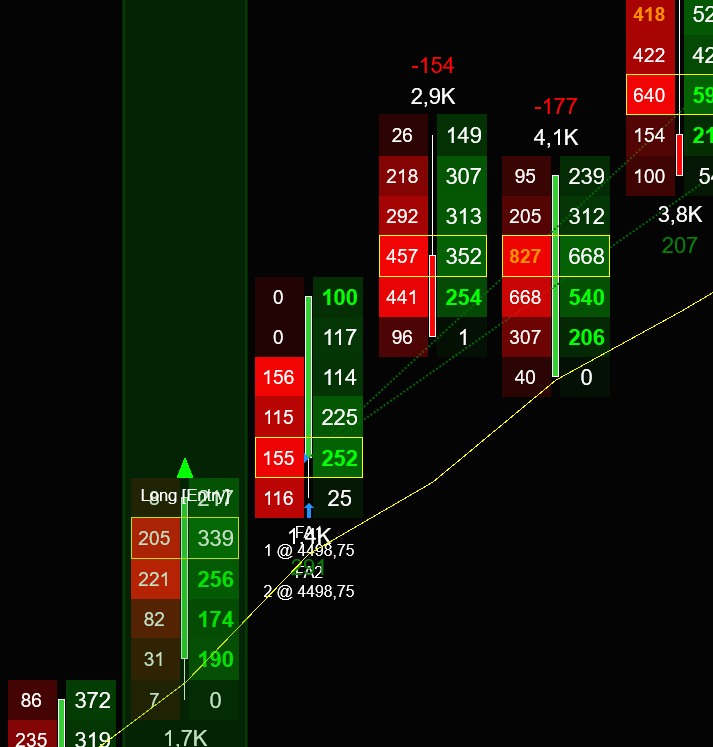

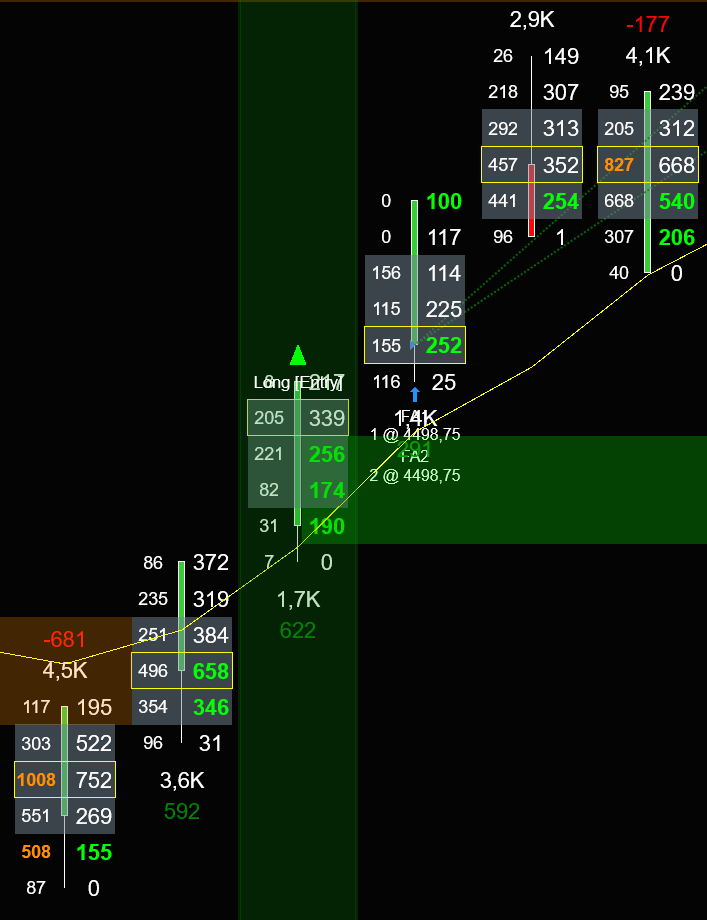

EXAMPLE:

On the image you can see that price made a new low which got quickly rejected. The first bar with delta +177 gave a delta surge signal because the last 4 bars (including signal bar) each had increasing delta (-443, -388, -158, +177) and the strategy went long exactly a the bar close resulting in a winner.

Delta Flip Signal

The Delta Flip signal is a 2-bar signal. It triggers when there is a sudden shift in Delta from positive to negative or from negative to positive and indicates a potential reversal.

LONG:

– The first bar closes on its min-delta and has a max-delta around 0

– The next bar closes on its max-delta and has a min-delta around 0

SHORT:

– The first bar closes on its max-delta and has a min-delta around 0

– The next bar closes on its min-delta and has a max-delta around 0

You can set accuarcy of 0 Delta with Delta Flip: precision parameter. Delta Flip: precision means how far delta can be away from min/max delta and from 0. Default is 40.

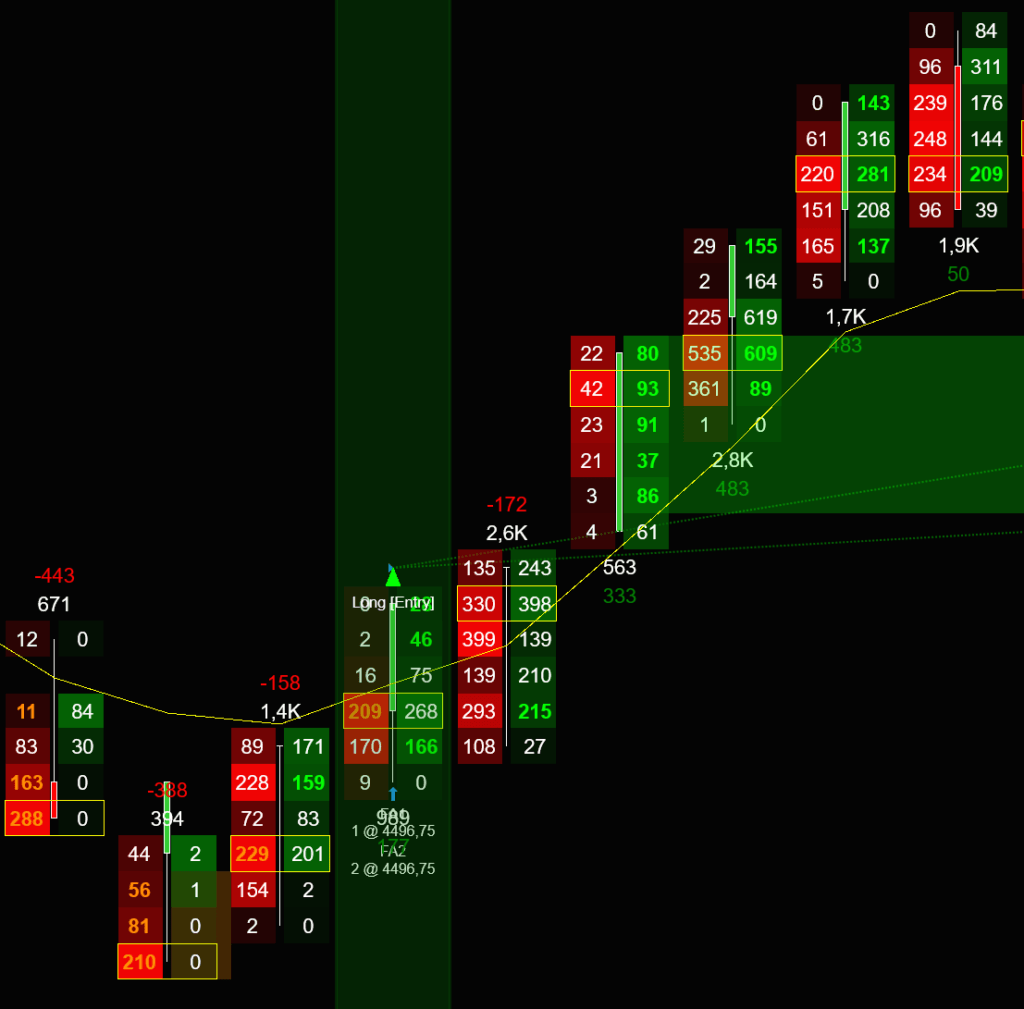

EXAMPLE:

1st bar: Max Delta is -1, Min Delta is -163, and Delta on close is -155.

2nd bar: Max Delta is 336, Min Delta is -30, and Delta on close is 335.

Delta Flip precision was 40.

Delta Trap Signal

The Delta Trap signal is a 3-bar signal which looks a delta reversing and followed with strength.

LONG:

– bar 1: big negative delta

– bar 2: big positive delta

– bar 1-3: ema 5 is up

– bar 3: big positive delta or a value area gap up

SHORT:

– bar 1: big positive delta

– bar 2: big negativedelta

– bar 1-3: ema 5 is down

– bar 3: big negative delta or a value area gap down

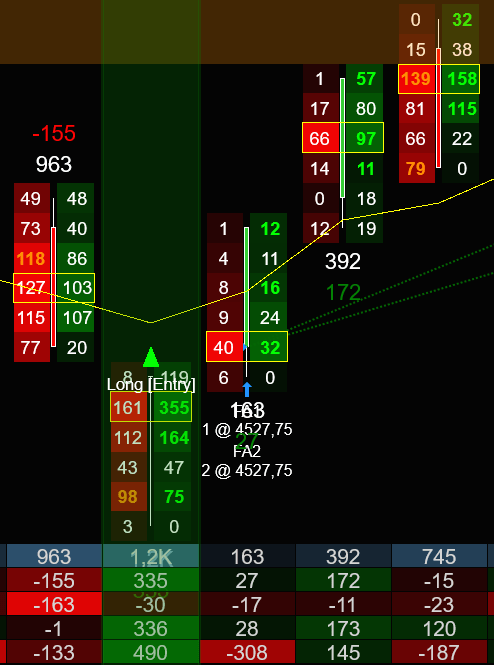

EXAMPLE:

On the image we can see an example. First bar had -681 Delta, next bar had +592 Delta and 3rd bar had a value area gap up AND high positive delta. The strategy would go long after the 3rd bar.

Delta Slingshot Signal

Delta Slingshot signal indicates a possible trend reversal when selling volume gets overrun by buying volume and market closing higher.

LONG:

– Bearish bar with extreme negative delta.

– Followed by a bullish bar which closes above the bearish bar with positive extreme delta.

SHORT:

– Bullish bar with extreme positive delta.

– Followed by a bearish bar which closes below the bullish bar with negative extreme delta.

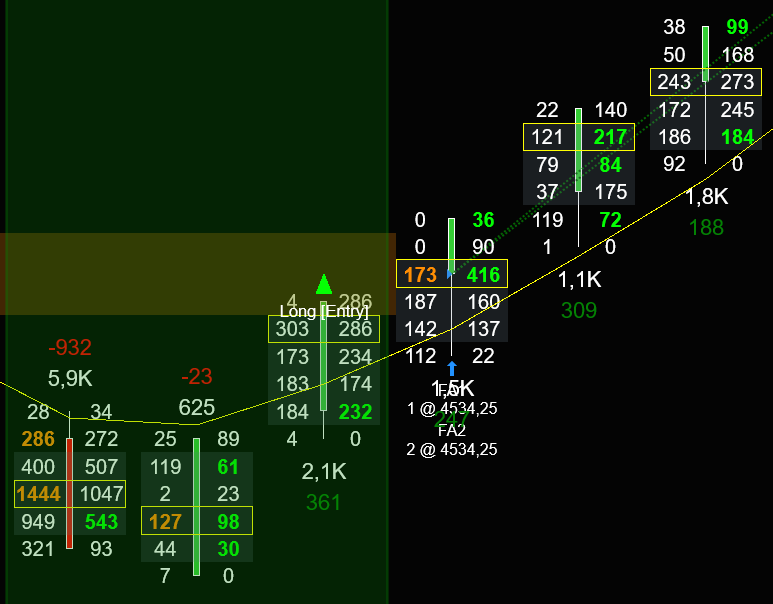

EXAMPLE:

In the example we see a red bar with -932 Delta. Then after a consilidation bar the next bar closes above the red bar with with +361 Delta.

Above/Below POC Signal

The Above/Below POC signal will open a trade whenever a bar opens and closes above or below the POC. For example, when both the open and the close are above the POC this is a clear indication that buyers and sellers stepped into the market and price will continue at least a little bit further.

LONG:

– A bullish bar that opens & closes above the POC at a swing low

SHORT:

– A bearish bar that opens & closes below the POC at a swing high

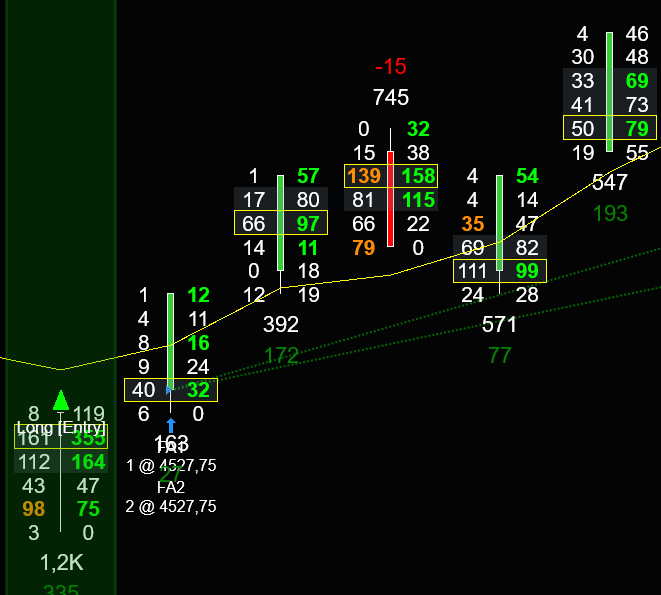

EXAMPLE:

On the image you can see an example of a doji candle opening and closing above the POC. The strategy opens long trade the moment the bar closes and quickly reaches profit.

Stacked Imbalances Signal

Stacked Imbalances occur when we have given number (or more) imbalances stacked on top of each other. The number of imbalances is set by Stacked Imbalances: number parameter. Default value is 3.

Also you can reverse the signal from the settings on the Ranging market to trade reversals.

LONG:

– Given number or more buy imbalances

SHORT:

– Given number or more sell imbalances

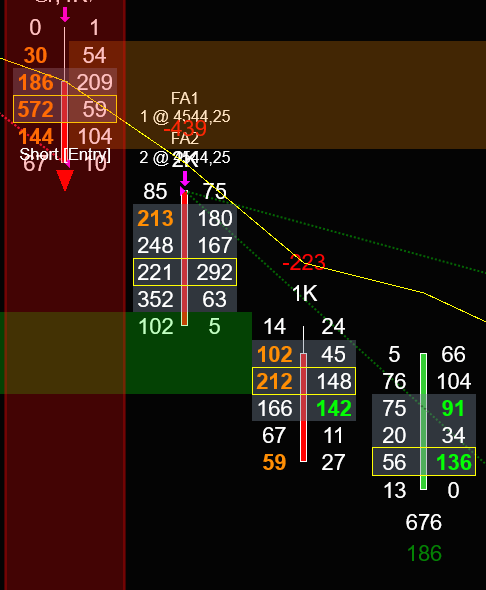

EXAMPLE:

In the example we see a sell imbalance being formed (30, 186, 572, 144) and as soon as the candle closes the strategy opens a short sell trade.

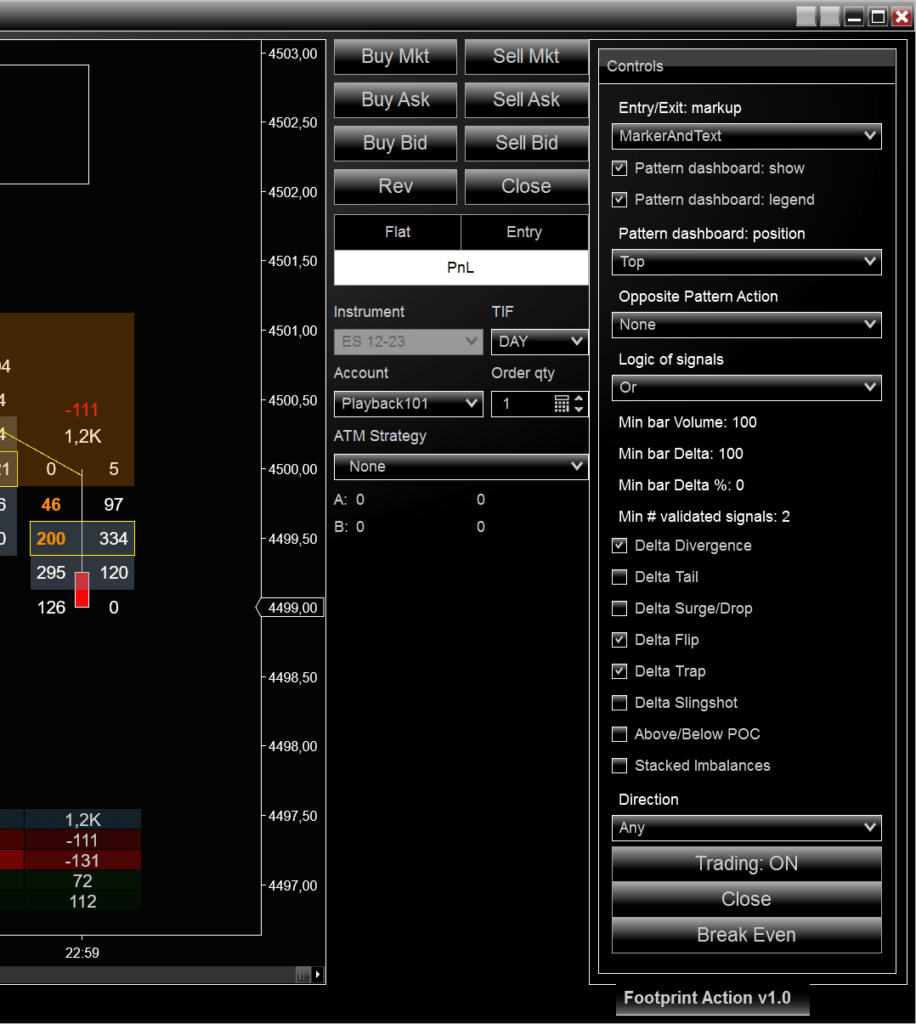

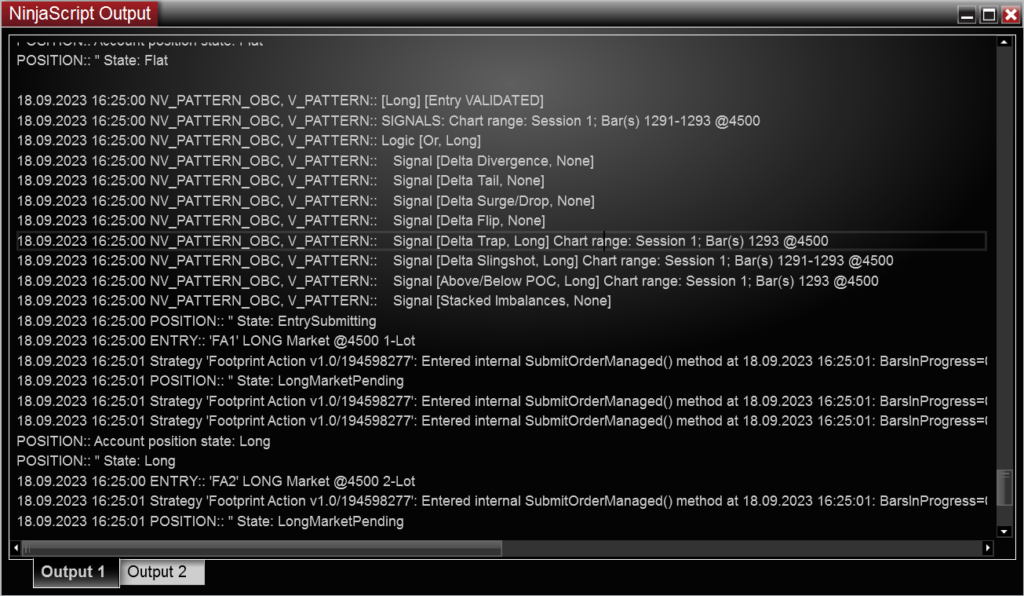

Create Orderflow Patterns

EXAMPLE:

The strategy will open a new trade when at least X of the active signals are confirmed. This allows you to (for example) select 6 signals and open a trade when at least 3 of those are confirmed.

To create this type of orderflow pattern do the following from the settings of the strategy:

– Choose Or for Logic of signals

– Select required one or many signals by clicking checkbox next to it

– Set Min # of validated signals = X

EXAMPLE:

The strategy will open a new trade when all active signals are confirmed.

To create this type of orderflow pattern do the following from the settings of the strategy:

– Choose And for Logic of signals

– Select required one or many signals by clicking checkbox next to it

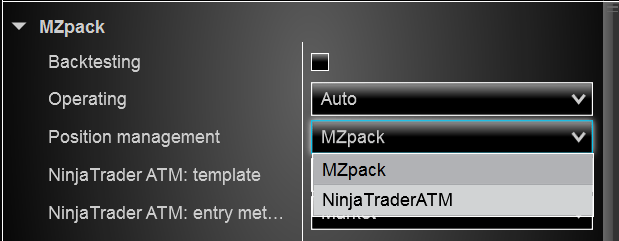

Position Management

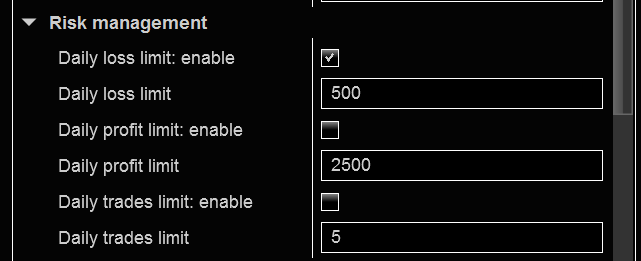

Risk Management

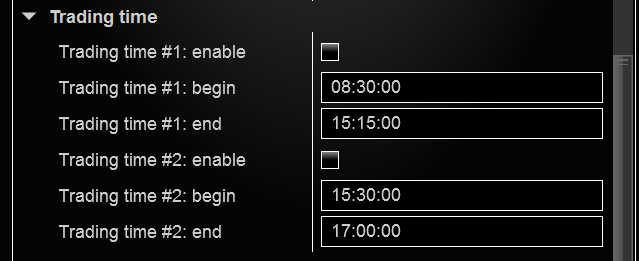

Trading Times

With the Trading times you can limit the times when the Footprint Action strategy is allowed to take any trades.

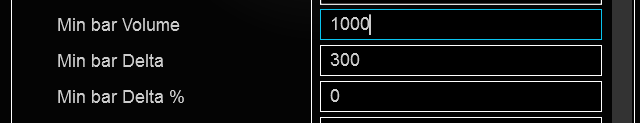

Volume, Delta and Delta % Filters

This filter will filter out any signals when the Volume, Delta and or Delta % is below the minimum level. NOTE, THE FILTER IS APPLIED TO ALL BARS OF THE SIGNAL.

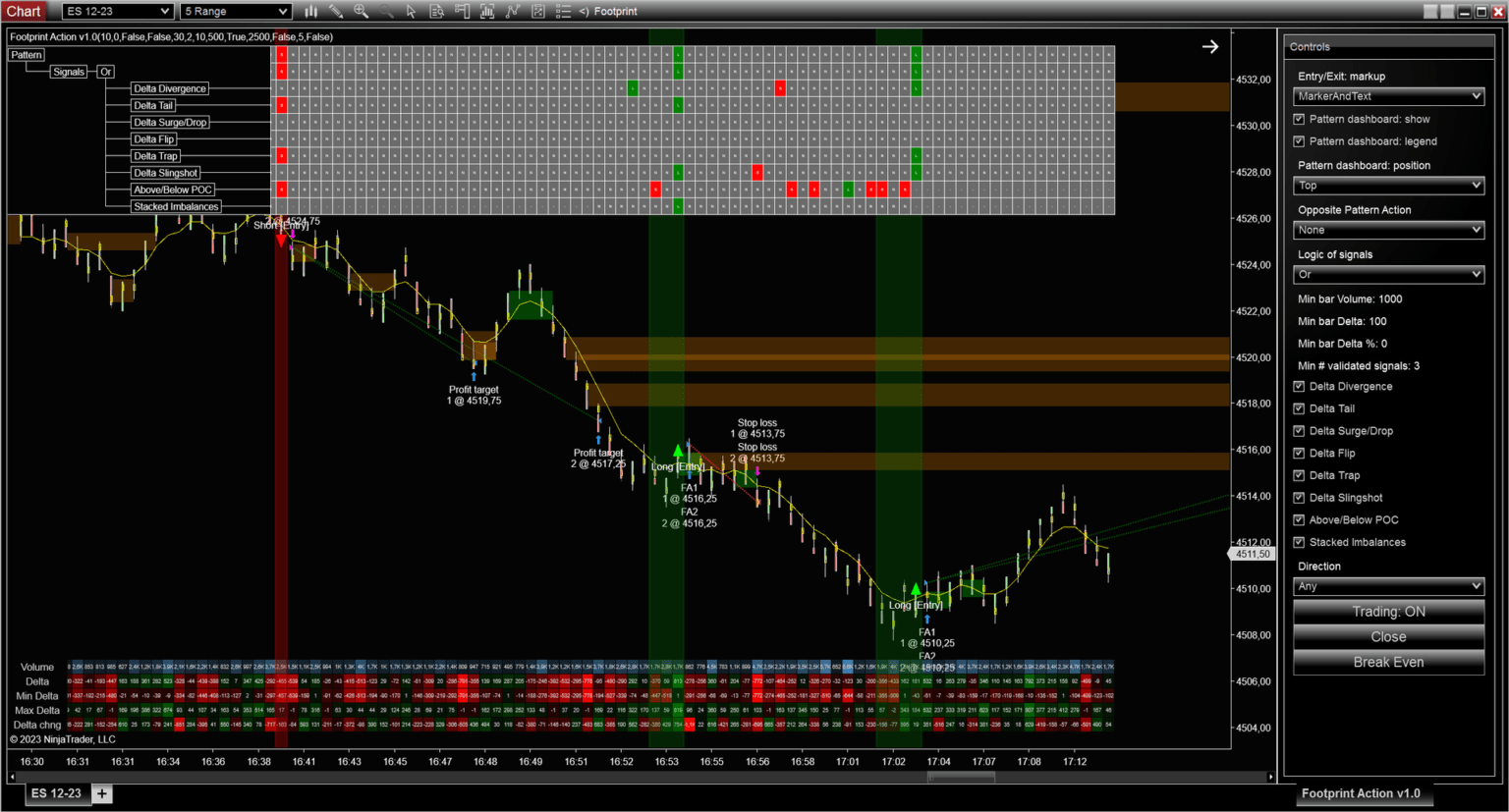

Pattern Dashboard

See in Pattern Dashboard how the pattern is calculated. Validated signal is market with a color box (red or green by default). Bars of validated pattern are marked with color background.

In this example, at least 3 signals must be validated/confirmed to open a trade. You can modify the pattern without disabling the strategy from strategy control panel.

Footprint Indicator

This strategy includes mzFootprint indicator. You can customize it but few of the settings can be saved in chart template.